June 1, 2023

Supply Chain Finance On The March

Nothing – not supply chain logjams, not higher interest rates, not economic uncertainty — could dampen the continued growth of Supply Chain Finance.

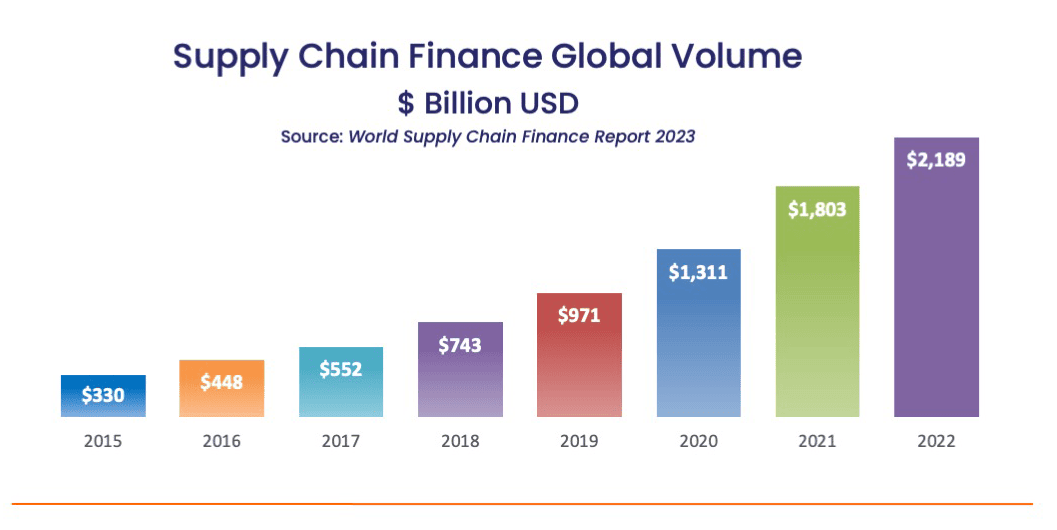

Global volume of Supply Chain Finance reached nearly $2.2 trillion in 2022, up 21% from 2021, according to BCR Publishing’s World Supply Chain Finance Report 2023.

Since 2015, the industry has expanded at a 31% compound annual growth rate.

In this report, we’ll examine the outlook for Supply Chain Finance, the factors that are driving its growth, and innovations that will carry it forward.

What’s Driving SCF Growth?

A combination of factors is pushing the rapid growth of Supply Chain Finance:

1. Continued Growth in Demand

The post-pandemic surge in economic activity drove huge demand for SCF as buyers and suppliers alike scrambled for new sources of working capital.

But supplier demand for early payment has been driven by a number of factors:

- A sharp increase in global inflation: In July of 2022, US inflation peaked at 9.1%, the highest rate in 40 years; Europe and Asia experienced similar rises. Inflationary pressures drove demand for early payment as the future value of money declined and suppliers sought immediate funds rather than waiting weeks or even months for payment.

- Rising interest rates: Central banks responded to inflation with sharp increased in interest rates. Borrowing costs rose, making SCF an attractive alternative, especially for small and mid-sized suppliers for whom debt financing can be expensive.

- Tightening credit markets: As access to credit was curtailed, suppliers needed additional sources of working capital. Supply Chain Finance gave them access to funds without borrowing – or the attendant risks to their balance sheets.

2. Growth in Supply

Supply rose to meet the growing demand for early payment.

Key drivers of Supply Chain Finance supply include:

- Buyers’ needs for a stable supply chain: Post-pandemic shortages put suppliers in the driver’s seat. It’s become critical for buyers to maintain access to key suppliers. Offering early payment options has proved to be a powerful tool for driving supplier satisfaction and loyalty.

- New investor interest: Traditionally, Supply Chain Finance was funded by banks, who provided funding for the near/investment-grade suppliers of the largest corporations. But success in the sector has drawn capital from other institutional investors seeking yield, increasing the pool of available capital and expanding access to mid-sized and smaller suppliers.

- The growth of Procure-to-Pay networks:

Procurement has moved online, and with it the links between buyers and suppliers. This provides a strong nexus for SCF providers — who can seamlessly integrate early payments into the invoicing and payments process.

2023 And Beyond

Supply Chain Finance continues to expand in popularity despite economic headwinds; indeed, we expect it to continue to grow because of these challenges.

With explosive growth comes increased attention from regulators. In late 2022, FASB announced new disclosure rules for buyers who offer Supply Chain Finance programs. IASB is expected to follow in 2023.

Many buyers utilizing SCF will be required to disclose key terms of their programs, as well as some key numbers associated with the programs. The disclosures will appear in the footnotes of their financials.

Complying with the new rules represents a new burden for buyers. Additionally, the disclosures can affect investors’ perception of key financial ratios – in particular, the debt to earnings ratio among others.

With this in mind, we expect to see a migration from traditional SCF programs toward those that do not require confirmation from buyers and are therefore exempt from FASB disclosure rules – including IFG’s Digital Supply Chain Finance program.

Despite Supply Chain Finance becoming commonplace for savvy corporate buyers, it’s often misunderstood, even by seasoned financial professionals. Here’s an overview of how it works.

What is Supply Chain Finance?

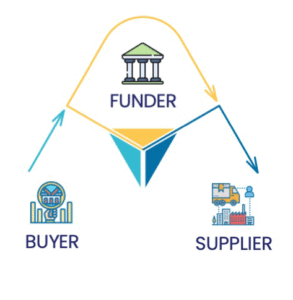

First, some definitions. Supply Chain Finance (SCF) is a buyer-led program that offers early payment to suppliers, with funding from a third party.

The mechanics are straightforward: The buyer’s SCF program allows its suppliers to opt for early payment of its invoices, less a small discount. The early payment is made by a third-party funder (usually a bank or fintech firm); and the funder is paid in full by the buyer on the invoice’s original due date.

Supply Chain Finance is just the latest iteration of Invoice Finance — the practice of early payment that has existed for over 4,000 years — from ancient Mesopotamia, to the Medicis of the Renaissance, to the Industrial Revolution of the 1800s, to today.

Why Supply Chain Finance?

Supply Chain Finance offers significant benefits to both buyers and suppliers. Buyers strengthen their supply chain by providing an affordable source of working capital to suppliers; they’re also able to maintain or extend their DPOs without harming supplier relationships. For suppliers, SCF is a powerful source of on-demand working capital, often at better terms than they could secure on their own.