PETER JACOBSTEIN, Chief Strategic Partnership Officer, The Interface Financial Group

January 27, 2022

Everyone knows: the less you need financing, the easier it is to get. Fortune 500 companies have virtually unlimited access to working capital solutions. But their suppliers, especially those in the long tail, often struggle. At best, securing working capital is cumbersome and expensive. At worst, it’s not available at all.

Today we’ll look at the roots of the issue, and how technology can save the day.

The Scope of the Problem

The Federal Reserve’s 2021 Small Business Credit Survey lays out the challenges that small businesses face in attaining capital.

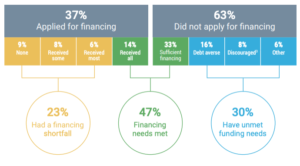

- Less than half of all firms (47%) had their funding needs fully met.

- 23% of firms applied for financing but did not get all the funding they needed.

- 30% of firms did not try to get funding at all, in many cases discouraged by the process or their prospects.

These issues are generally well understood. The question is why they are allowed to persist? And how can technology lead the way to a better system of providing working capital to small and mid-sized businesses?

Supply Chain Finance – A Key Source of Working Capital

A look at Supply Chain Finance illustrates the challenges of funding small and mid-sized businesses, but also points to the ways in which technology can help level the playing field.

First, some history: the purchase of receivables as a funding source for suppliers is a 4,000 year-old industry. It existed in Mesopotamian times; and it was a source of the Medicis’ wealth during the Renaissance.

Today’s Supply Chain Finance (SCF) is an update of the process, led by buyers for the assistance of their suppliers. In SCF, a supplier can opt for early payment of invoices that have been approved and scheduled for payment by their buyer. A third party (typically a bank or non-band funder) pays the invoice, less a small discount, and is then paid in full by the buyer when the invoice is due.

There is a risk that the invoices it pays on behalf of suppliers will not be paid in full by the buyer. This risk is called Post-Confirmation Dilution, and it’s more common than you might think. Chargebacks, set-offs, and disputes are all reasons why a buyer might not pay an invoice in full – even one that’s been approved and scheduled for payment.

So as with all funders, those that provide Supply Chain Finance put measures in place to avoid losses. But this often made it harder for small and mid-sized suppliers to get funding.

Supply Chain Finance – The First Wave

SCF has historically been provided by banks. Indeed, even today banks are the largest providers of SCF. And if there’s one thing banks are known for, it’s making sure they get their money back. This generally means an intensive credit review process, and often strict collateral requirements.

For Bank-led SCF, the process is somewhat different, but no less strict. Indeed, banks limit their risk in Supply Chain Finance in two critical ways:

- A guarantee of payment from the buyer on all invoices funded, often referred to as an Irrevocable Payment Undertaking (IPU).

- An intensive focus on investment-grade and near investment-grade suppliers

While these efforts can limit the risk associated with Supply Chain Finance, they also have the effect of reducing access – in two key ways:

- Buyers are less likely to offer an early payments program given the constraints of guaranteeing payment.

- Small and mid-sized suppliers who need working capital most are often shut out of the programs.

Supply Chain Finance – Fintech Challengers

Banks’ focus on large suppliers opened an opportunity for tech-driven challengers. Using new digital technology to automate the process, fintechs have been able to bring SCF to smaller suppliers. Older, more cumbersome onboarding was replaced with buyer-fed data and supplier self-service tools. The result has been lower marginal costs for SCF providers – and the ability to offer SCF to smaller companies.

But while the fintechs offered greater access through greater efficiency, they have not generally offered improvements in underwriting and credit. Indeed, virtually all fintech providers today still rely on buyer guarantees of payment. And as with banks, this has the effect of reducing the number of buyers willing to offer their suppliers an early payments program…and by extension the number of suppliers who can benefit.

Supply Chain Finance – The Third Wave Brings Inclusivity

Even with fintech innovation, there’s still a missing piece in Supply Chain Finance: a better understanding and management of risk. Because with proper underwriting, SCF can be open to virtually all suppliers, even in cases where buyers don’t want to sign a guarantee of payment to participate.

This leads us to the third wave of Supply Chain Finance involving fast data, and real-time underwriting decisions.

Here’s how it works in the third wave: A third party funder crunches vast amounts of data to assign each supplier a real-time credit limit. This data might include the payment history between the buyer-supplier pair, along with thousands of other data points. The supplier can opt for early payment on invoices from the funder at any time, up to the amount of that credit limit.

In this scenario, everyone wins:

- The buyer doesn’t have to sign a guarantee of payment – dramatically increasing the pool of buyers willing to offer an early payments program

- The supplier can take funding in real time – and virtually every supplier is included.

The Bottom Line

Everyone understands that access to working capital is a critical issue for small and mid-sized suppliers. It’s not that funders don’t want to help. The primary issue is systems-related: most providers of capital simply don’t have the credit expertise or the technological sophistication to solve the problem.

For 50 years, IFG has been on a mission to provide access to working capital. IFG’s Digital Supply Chain Finance is one of the most powerful tools available to ensure that every supplier has the opportunity for funding. Our Dynamic Credit Limit represents the best in third-wave SCF.

If you’re interested in learning more, let us know.