A Bruising Market Hits the Smallest Hardest

Peter Jacobstein, Chief Strategic Partnership Officer, The Interface Financial Group January 12, 2021 |

A recent Harvard Business Review article paints a dire picture for small and mid-sized suppliers (SMEs), and for the larger companies that depend on them.

“A Financial Crisis is Looming for Smaller Suppliers[1]” argues that the global pandemic is only the latest challenge to challenge the liquidity of small companies.

- Beginning with the 2008 financial crisis, buyers began extending payment terms to preserve cash, resulting in a decade-long expansion of Days Payable Outstanding. Small and mid-sized businesses bore the brunt of extended payment terms but lacked the leverage to extend their own.

- Tighter banking regulations have hindered the ability of less well-funded businesses to secure bank financing. Even with interest rates at historic lows, SMEs have struggled to get working capital.

So, in 2020 the global financial crisis brought on by COVID was especially damaging to smaller firms.

This should matter to all businesses – even large buyers, for three reasons:

- Maintaining the viability of the supply chain is critical – whether suppliers are large or small companies.

- In a world where Corporate Social Responsibility has moved to center stage, supporting small and mid-sized suppliers is an ethical imperative.

- Small businesses account for nearly half of the U.S. GDP, making the health of small businesses an economic imperative for our country.

WHAT CAN RESPONSIBLE BUYERS DO?

All buyers have a role in ensuring the stability of the supply chain – and the larger business ecosystem.

The simplest thing buyers can do is to pay promptly. Doing so ensures that small and mid-sized suppliers have access to the working capital they need.

Of course, this is easier said than done. Buyers of all sizes are as affected by liquidity concerns as their suppliers.

So when shorter terms aren’t possible, third party funding can fill the gap. Digital Supply Chain Finance is a financial product engineered for exactly this situation.

THE IMPACT OF AN EARLY PAYMENT PROGRAM

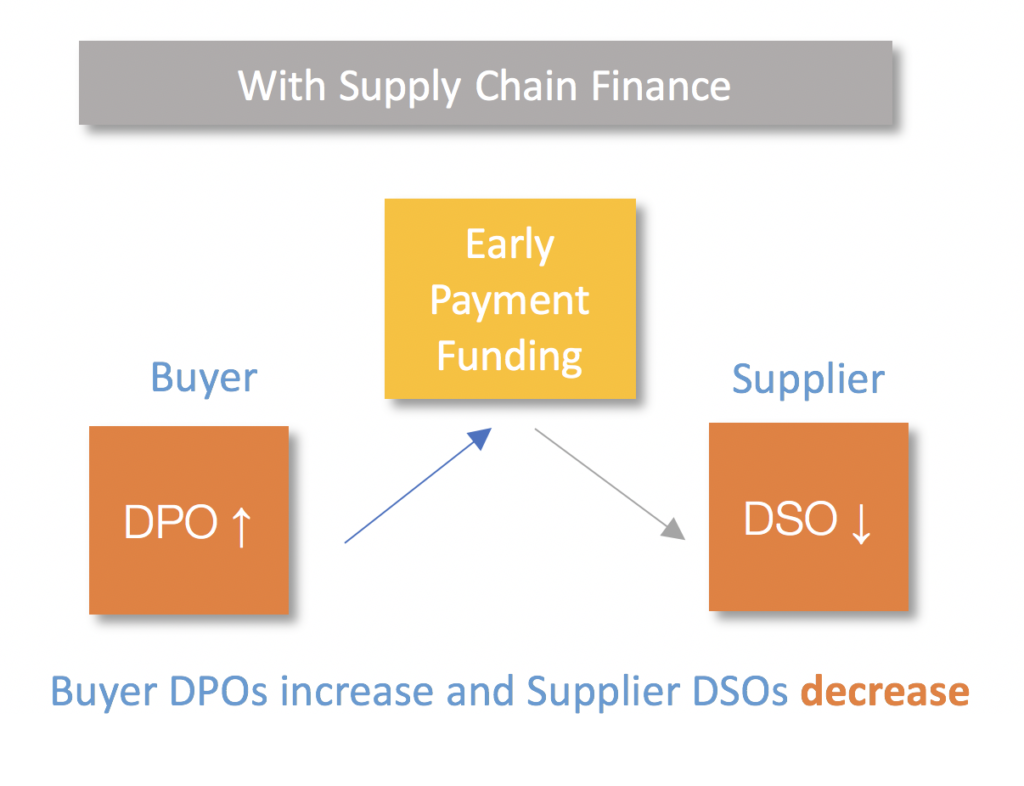

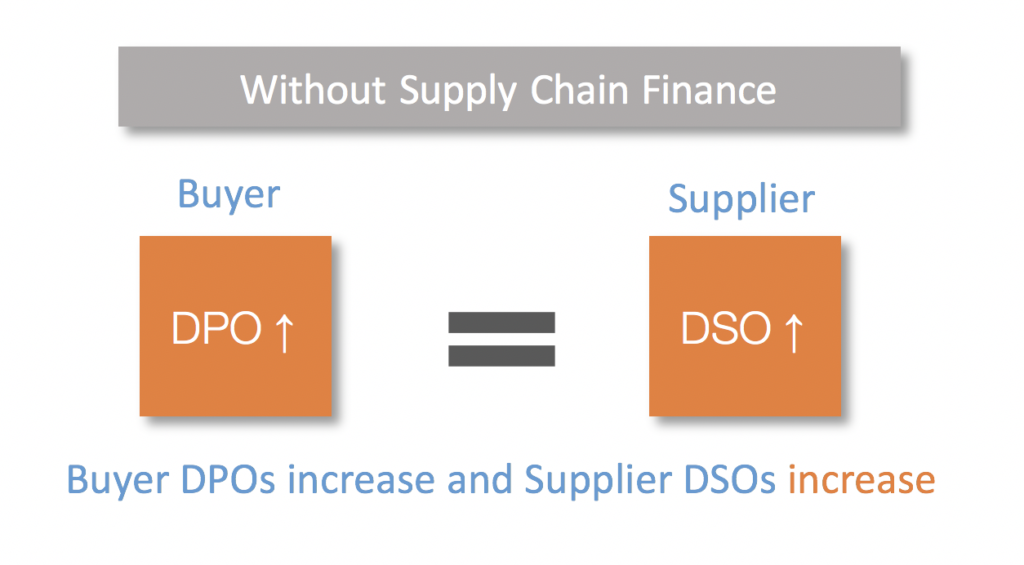

In a traditional buyer-supplier relationship, there’s a 1-1 relationship between the buyer’s Days Payable Outstanding (DPO) and the supplier’s Days Sales Outstanding (DSO). As a buyer extends payment terms, the supplier’s outstanding receivables grow. It’s good for the buyer; but bad for the supplier.

Digital Supply Chain Finance uncouples this relationship. The buyer maintains its terms, but the supplier is paid early by a third-party funder in exchange for a small discount to the value of the invoice. Both the buyer and the supplier achieve a cash flow benefit.

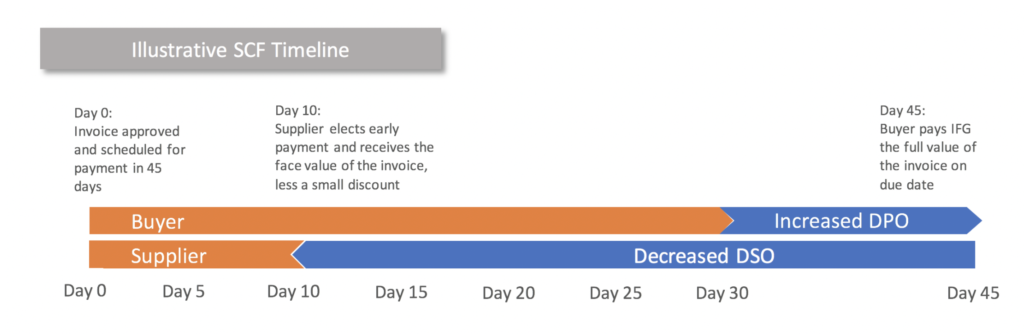

The chart below shows how Digital Supply Chain works in practice. The supplier receives payment early – just ten days after its invoice is approved. But the buyer actually pays the invoice as scheduled – forty-five days after approval. The funding for that interim thirty-five days comes from a Supply Chain Finance provider.

THE BENEFITS OF SUPPLY CHAIN FINANCE

An effective Supply Chain Finance program can benefit buyer and supplier. But it’s critical to find the right kind of program. The best SCF programs:

- Cost nothing for buyers, and require no process changes to existing AP practices

- Don’t require a buyer guarantee of payment

- Provide funding for ALL suppliers, including small and mid-sized businesses that need it most

- Provide affordable funding for suppliers — just a small discount to invoice value, with no other fees or expenses for suppliers

- Provide 24/7 online access for early payment and simple supplier registration

THE BOTTOM LINE

Supporting small suppliers is a business imperative and an ethical imperative for buyers. When a buyer’s terms can’t be shortened (or are being expanded), Digital Supply Chain Finance is a simple way to offer a tangible benefit to suppliers who need it most.

[1] Federico Caniato, Antonella Moretto and James B. Rice, Jr. “A Financial Crisis is Looming for Smaller Suppliers,” Harvard Business Review, August 6, 2020, https://hbr.org/2020/08/a-financial-crisis-is-looming-for-smaller-suppliers